2024 Legislative Updates - Week 4

2024 Legislative Session

Legislative Days 11-14 February 2, 2024

Session Persists Despite Losses

Session Persists Despite Losses

It’s been a somber week at the Georgia State Capitol. On Monday, a state trooper was killed in the line of duty. The Pentagon announced three Georgia-based soldiers were killed in a drone strike on a US base in Jordan over the weekend. On January 30, members of the General Assembly arrived at the Capitol to learn that House Rules Chairman Richard Smith (R-Columbus) passed away from complications of the flu. He was first elected to the House 20 years ago and previously served as Chairman of the House Insurance Committee. Vice Chair Mandi Ballinger (R-Canton) is expected to lead the committee in the interim.

|

|

Despite the subdued spirit, the legislature had an active week, with floor debate and a full slate of committee meetings each day they were in session. Next week will be an active four days in Chambers as lawmakers approach the midpoint of the session on Tuesday, February 13 and the critical Crossover Day milestone on Thursday, February 29.

Legal Reform and the Courts

Premises Liability Reform. The House is expected to lead on premises liability reform with support from Speaker Jon Burns. The hope is that legislation will be introduced in the coming weeks.

Apex Doctrine (SB 431)

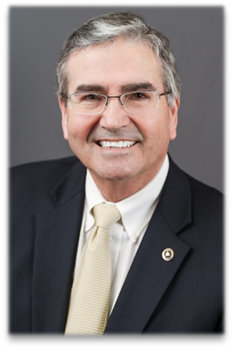

Sen. Blake Tillery, R-Vidalia

Assigned to the Senate Judiciary Cmte on Jan-31

In June 2022, a Georgia Supreme Court ruling rejected the apex doctrine, which protects high-ranking corporate and government officials from unwarranted depositions. In 2023, the General Assembly passed SB 74 to codify those protective orders. Now, SB 431 appears to strike language added in 2023 and therefore again subjects those high-ranking corporate and government officials to depositions.

In June 2022, a Georgia Supreme Court ruling rejected the apex doctrine, which protects high-ranking corporate and government officials from unwarranted depositions. In 2023, the General Assembly passed SB 74 to codify those protective orders. Now, SB 431 appears to strike language added in 2023 and therefore again subjects those high-ranking corporate and government officials to depositions.

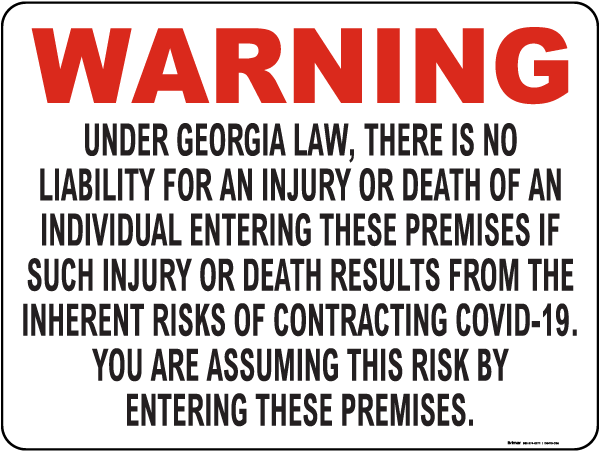

COVID-19 Liability Claims (SB 430)

Sen. Greg Dolezal, R-Alpharetta

Assigned to the Senate Economic Development and Tourism Cmte on Jan-31

SB 430 revises guidelines for rebuttable presumption of risk by claimants in certain COVID-19 liability claims. Specifically, it repeals warning requirements that became ubiquitous during the pandemic.

Magistrate Court Claims (HB 967)

Rep. Martin Momtahan, R-Dallas

Pending in the House Judiciary Cmte

Magistrate Courts (sometimes called small claims courts) have authority over tort and contract claims under $15,000. HB 967 increases the threshold to $50,000.

Magistrate Court Fees. The Association is currently tracking several bills that allow local magistrate courts to assess a technology fee or law library fee on all filings.

Landlord-Tenant

Squatter Reform Act (HB 1017)

Rep. Devan Seabaugh, R-Marietta

Pending in the House Judiciary Cmte

HB 1017 amends the definition of criminal trespass to include when a person enters a land or premises for purposes of residing on such land or premises. It provides for the submission of a property affidavit in magistrate court. There was additional discussion in a House Judiciary Non-Civil subcommittee on Jan-29 regarding HB 922 and whether squatters could be removed from property under the existing criminal trespass code.

Safe at Home Act (HB 404)

Rep. Kasey Carpenter, D-Dalton

Pending in the Senate Judiciary Cmte

Introduced by a bipartisan group of lawmakers, the Safe at Home Act makes several changes throughout the landlord-tenant act including:

-

- Requiring leases to state explicitly that the dwelling is fit for human habitation

- Adding “cooling” to the list of utilities that the landlord must make available

- Limiting security deposits to no more than two months’ rent

- Creating a three-business day right to cure, posted on the door, and sent by terms agreed to in the lease.

While HB 404 was placed on the Senate’s final debate calendar last year, it was not called for a vote. It is now back in the Senate Judiciary Committee where it can again receive a “do pass” recommendation or undergo further revisions. Tenant advocates continue to press for changes to the legislation, which the industry deems unacceptable.

Property Management and Property Rights

Elevator and Boiler Updates (SB 417)

Sen. John Albers, R-Roswell

Assigned to the Senate Judiciary Cmte on Jan-30

SB 417 deals with accidents involving elevators, dumbwaiters, escalators, manlifts, and moving sidewalks. It requires the owner or lessee to report the accident by the end of the next business day. Current law allows for a seven-day window. SB 417 deletes language that requires the report be filed in writing. It allows the Commissioner of Insurance to approve deputy inspectors who have completed a nationally recognized program to inspect boilers and pressure vessels. It increases the frequency of pressure vessel inspections to once every two years. It updates state law dealing with hazardous chemical protection and allows material safety data sheets to be provided to employees in a written or electronic format.

Property Taxation and Valuation

Statewide Ad Valorem Property Tax Limit (SB 364)

Sen. John Albers, R-Roswell

Considered by the Senate Finance Cmte on Jan-29

SB 364 provides for a statewide homestead exemption from ad valorem taxes in an amount equal to any amount by which the current year assessed value of a homestead exceeds the lesser of 3% or the inflation rate from the adjusted base year value of such homestead.

Property Tax Reform (SB 349)

Sen. Chuck Hufstetler, R-Rome

Pending in the Senate Finance Cmte

SB 349 makes several substantive changes to the state’s property taxation and appeal process. Notably, it limits so-called 299(c) property value freezes to instances where the value is actually reduced as a result of the appeal. Current law allows a freeze even if the value is unchanged. It also aims to cap property tax increases on homesteaded property statewide to no more than 3% annually via a floating homestead exemption.

During a Jan-22 Senate Finance meeting, lawmakers noted media reports that estimate commercial and multifamily properties are severely undervalued, particularly in Fulton and surrounding counties. Other lawmakers noted that capping property tax increases on homesteaded property leads to increased taxes on non-homesteaded residential, commercial, and industrial parcels.

Code Enforcement, Land Use & Development

Development Impact Fees (HR 303 / HB 585)

Rep. Todd Jones, R-Cumming

Favorably reported from the House Governmental Affairs Cmte on Jan-31

These measures authorize local boards of education to impose, levy, and collect development impact fees and use the proceeds to pay for additional educational facilities. It is currently drafted to apply only to Forsyth County. Across the Capitol, a similar pair of measures (SB 208 / SR 189) is also active in the Senate Rules Committee. The Association opposes expanding impact fees for education and granting school boards the authority to impose such fees.

Local Regulatory Fees (HB 461)

Rep. Brad Thomas (R-Holly Springs)

Favorably reported from the House Ways and Means Cmte on Feb-1

HB 461 requires local governments to approximate the actual cost of regulatory services they provide and use the fees exclusively for that regulatory activity. The legislation prohibits local governments from charging a regulatory fee that is calculated as a percentage of project costs. In 2022, local governments fiercely opposed a similar bill (HB 302), claiming it would restrict their ability to determine building inspection fees.

Rezoning Moratorium (HB 514)

Rep. Dale Washburn, R-Macon

Pending in Conference Committee

As introduced, HB 514 limits zoning moratoriums to no more than 180 days. The Association worked to amend the measure to protect all residential property from zoning moratoriums, not just single-family. On the final day of the 2023 session, it was amended to include language from SB 136, which allows local governments to waive development impact fees on workforce housing projects without backfilling the fee.

Infrastructure and Community Development Act (SB 435 / SR 533)

Sen. Frank Ginn, R-Danielsville

Assigned to the Senate Regulated Industries and Utilities Cmte on Jan-31

In 2023, Sen. Frank Ginn chaired a study committee focused on Service Delivery Strategy agreements; these are a tool available to cities and counties to allocate government services. However, they require periodic renegotiation, which often pits local governments against each other. SB 435 addresses this by allowing for the creation of independent infrastructure and community development districts. These districts provide an alternative method to manage and finance basic services but do not have zoning or development permitting powers. There is some confusion as to whether the author intended to allow these districts to acquire property using eminent domain. SR 533 asks voters to amend the Georgia constitution to permit these community development districts.

Taxation & General Business Legislation

Reduce the Income Tax Rate (HB 1015)

Rep. Lauren McDonald, R-Cumming

Favorably reported from the House Ways and Means Cmte on Feb-1

HB 1015 reduces the rate of state income tax from 5.49% to 5.39%. This is one of the priorities of the Governor.

The Georgia Consumer Privacy Act will be filed in the coming weeks with the aim of protecting the privacy of consumer personal data. Specific language is still being finalized.

Artificial Intelligence is a leading topic of conversation among lawmakers this year. Already, legislation (HB 887) has been filed to prohibit the use of Artificial Intelligence (AI) in making health insurance decisions, discrimination (HB 890), and AI usage by state agencies (HB 988). This week lawmakers considered legislation to prohibit “deep fake” campaign advertisements (HB 986). While there are likely to be several more bills introduced, lawmakers may opt to study the issue (via SR 476) before advancing legislation.