2024 Legislative Updates - Week 6

Legislative Days 19-22 February 16, 2024

Race to Crossover

The General Assembly was active each day this week. House and Senate committees convened for 120 meetings to consider more than 200 measures, ultimately sending 82 on to the Rules Committees.

The harried pace is due to the looming Crossover Day deadline, set for Thursday, February 29. To receive additional consideration this session, Senate bills must pass the Senate, and House bills must pass the House by adjournment on Crossover Day. Committees are working doggedly to move bills to the Rules Committees, making them eligible for a vote by the full chamber. As the session edges closer to the significant Crossover Day milestone, time and energy will shift away from committees, and time spent on the House and Senate floor will increase dramatically.

Landlord-Tenant

Off-Duty Sheriff for Set Outs (HB 1203)

Rep. Trey Kelly, R-Cedartown

Favorably reported from the House Judiciary Cmte on Feb-13

HB 1203 authorizes landlords to use off-duty sheriffs, constables, marshals, and other POST-certified law enforcement officers to execute writs of possession if the marshal, sheriff, or constable does not execute within 14 days of the application. Local law enforcement must maintain a list of authorized off-duty personnel and provide that information to the landlord upon request. The landlord must provide written notice of the execution of the writ.

The Committee adopted several amendments before giving it a do-pass recommendation. The Association testified in support of the bill. Despite acknowledging the significant backlog on both the court and set-out side of the eviction process, the Fulton County Marshal’s Office spoke in opposition to the measure.

Safe at Home Act (HB 404)

Rep. Kasey Carpenter, D-Dalton

Favorably reported from the Senate Judiciary Cmte on Feb-12

Introduced by a bipartisan group of lawmakers in 2023, the Safe at Home Act makes several changes throughout the landlord-tenant act including:

-

- Requiring leases to state explicitly that the dwelling is fit for human habitation,

- Adding “cooling” to the list of utilities that the landlord must make available,

- Limiting security deposits to no more than two months’ rent, and

- Creating a three-business day right to cure, posted on the door, and sent by terms agreed to in the lease.

Tenant advocates stood down on their effort to amend the bill with additional pro-tenant measures in the Feb-12 meeting, but signaled their ongoing efforts to reform Georgia’s landlord-tenant statute. The Committee updated the effective date of the bill, a technical move that will require the House to agree to the change after it is adopted by the Senate.

Allow Rent Control (SB 125)

Sen. Donzella James, D-Atlanta

Favorably reported from the Senate Urban Affairs Cmte on Feb-15

SB 125 repeals the statewide ban on local government controlling rental prices for privately owned, single-family, or multi-unit residential rental property. Introduced last year, the bill was originally assigned to the Senate State and Local Governmental Operations Committee. On Feb-13, Sen. Donzella James scored a procedural victory and moved the bill to the Senate Urban Affairs Committee. Sen. James chairs this committee and it is comprised exclusively of Democratic lawmakers – the only committee in the Senate without a Republican majority.

Not surprisingly, the committee gave a do-pass recommendation to SB 125, but it is unlikely to advance further. The Association provided information to committee members that artificially depressing rent reduces the quantity and quality of available housing. Other rent control bills (HB 534, HB 627, HB 719, HB 852, HB 1156) also remain active.

Squatter Reform Act (HB 1017)

Rep. Devan Seabaugh, R-Marietta

Considered by the House Judiciary Cmte on Feb-13

HB 1017 addresses the issue of squatters through the criminal trespass code. This allows police to take action directly, rather than civil courts. It also contains language to create a new offense related to false or fraudulent lease or rental agreements. House Judiciary Committee members agreed on the need to remove squatters more efficiently than is currently allowed but questioned the process prescribed in HB 1017. Other legislation to address squatters include HB 1153, SB 470, and HB 1227.

Legal Reform and the Courts

Data Analysis for Tort Reform (HB 1114)

Rep. Will Wade, R-Dawsonville

Favorably reported from the House Insurance Cmte on Feb-15

HB 1114 is the Governor’s data request bill to support tort reform. It authorizes the Insurance Commissioner to request data from insurers, licensed rating organizations, and state agencies regarding the impact of tort lawsuits and the assessment of tort-related risks. Data is not subject to open record laws. The legislation alludes to “anecdotal evidence” that indicates insurers are exiting the Georgia market or have stopped writing new business due to the state’s civil liability environment.

HB 1114 is the Governor’s data request bill to support tort reform. It authorizes the Insurance Commissioner to request data from insurers, licensed rating organizations, and state agencies regarding the impact of tort lawsuits and the assessment of tort-related risks. Data is not subject to open record laws. The legislation alludes to “anecdotal evidence” that indicates insurers are exiting the Georgia market or have stopped writing new business due to the state’s civil liability environment.

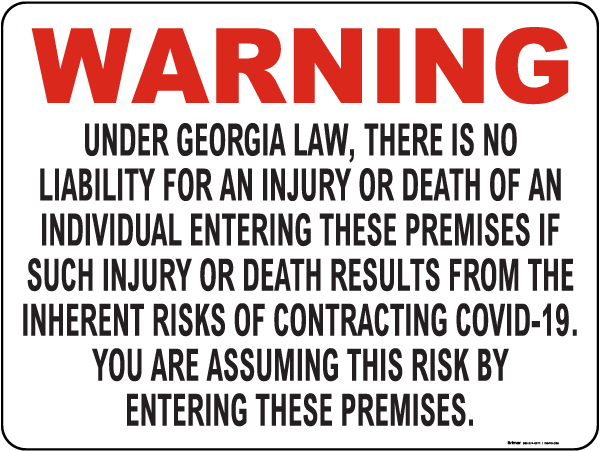

COVID-19 Liability Claims (SB 430)

Sen. Greg Dolezal, R-Alpharetta

Adopted by the Senate on Feb-15

SB 430 revises guidelines for rebuttable presumption of risk by claimants in certain COVID-19 liability claims. The liability protections remain in place, but the legislation repeals the warning requirements that became ubiquitous during the pandemic.

Premises Liability Reform. The House is expected to lead on premises liability reform with support from Speaker Jon Burns. The hope is that legislation will be introduced in the coming weeks.

Property Management and Property Rights

Short Term Rentals (HB 1121)

Rep. Bethany Ballard, R-Warner Robins

Pending in the House Governmental Affairs Cmte

HB 1121 prohibits local governments from suspending or prohibiting the continued use of property as a short-term rental unit by a property owner. Local governments can suspend or prohibit a short-term rental only if the property has violated local laws three or more times or the owner fails to pay applicable fees or obtain necessary permits.

Elevator and Boiler Updates (SB 417)

Sen. John Albers, R-Roswell

Considered by the Senate Public Safety Cmte on Feb-15

SB 417 deals with accidents involving elevators, dumbwaiters, escalators, man lifts, and moving sidewalks. It requires the owner or lessee to report the accident by the end of the next business day. Current law allows for a seven-day window. SB 417 deletes language that requires the report to be filed in writing. It allows the Commissioner of Insurance to approve deputy inspectors who have completed a nationally recognized program to inspect boilers and pressure vessels. It increases the frequency of pressure vessel inspections to once every two years. It updates state law dealing with hazardous chemical protection and allows material safety data sheets to be provided to employees in a written or electronic format.

Property Taxation and Valuation

Property Tax Reform (SB 349)

Sen. Chuck Hufstetler, R-Rome

Adopted by the Senate on Feb-15

SB 349 makes several substantive changes to the state’s property taxation and appeal process. Notably, it limits so-called 299(c) property value freezes to instances where the value is actually reduced as a result of the appeal. Current law allows a freeze even if the value is unchanged. It also aims to cap property tax increases on homesteaded property statewide to no more than 3% annually via a floating homestead exemption.

Allow Value Freezes Only on Homesteaded Property (HB 1120)

Rep. Darlene Taylor, R-Thomasville

Considered by a House Ways and Means Subcmte on Feb-12

HB 1120 excludes all non-homesteaded residential property from the two-year post-appeal valuation freeze allowed in current law. Local government advocates characterized non-homesteaded property owners utilizing the freeze as “taking advantage of a loophole” to the detriment of municipal coffers. Ways and Means subcommittee members were not receptive to this legislation.

Mandatory Reappraisal and Roll-Back Information (HB 1031)

Rep. Dale Washburn, R-Macon

Pending in the House Rules Cmte

As introduced, HB 1031 requires the chief appraiser to reappraise every parcel in 2025 and every three years thereafter. It requires estimated roll-back rate information to be included in the annual assessment notice. During a subcommittee hearing on Feb-7, it was amended to include language that only grants a post-appeal value freeze when the value is actually reduced as a result of the appeal.

Statewide Ad Valorem Property Tax Limit (SB 364)

Sen. John Albers, R-Roswell

Pending in the Senate Finance Cmte

SB 364 provides for a statewide homestead exemption from ad valorem taxes in an amount equal to any amount by which the current year assessed value of a homestead exceeds the lesser of 3% or the inflation rate from the adjusted base year value of such homestead. Similar legislation is also active as HB 1177 and HB 1185.

Code Enforcement, Land Use & Development

Development Impact Fees (HR 303 / HB 585)

Rep. Todd Jones, R-Cumming

Remanded back to the House Governmental Affairs Cmte on Feb-15

These measures authorize local boards of education to impose, levy, and collect development impact fees and use the proceeds to pay for additional educational facilities. It is currently drafted to apply only to Forsyth County. Across the Capitol, a similar pair of measures (SB 208 / SR 189) is also active in the Senate Rules Committee. The Association opposes expanding impact fees for education and granting school boards the authority to impose such fees.

Rep. Jones presented his pair of measures to the House Rules Committee on Feb-7 and fielded a barrage of questions from his colleagues. They specifically questioned why the bill didn’t include an automatic repeal when the county no longer meets the definition of “high growth.” Members noted that county development authorities continue to offer incentives while simultaneously taking property off the tax digest leading to budget shortfalls for school systems. The House Rules Committee sent HB 585 back to committee on Feb-15, signaling it needs additional work before further consideration.

Revise Low-Income Housing Tax Credits (HB 1182)

Rep. Clint Crowe, R-Jackson

Pending in the House Ways and Means Cmte

Introduced as part of the larger tax credit reform package, HB 1182 rebrands the low-income housing tax credit to the Georgia affordable housing tax credit. It allows credits to be leveraged for the development of affordable housing for seniors, veterans, and “targeted” areas, including rural locations. It reduces the amount of credits for certain projects.

Rezoning Moratorium (HB 514)

Rep. Dale Washburn, R-Macon

Pending in Conference Committee

As introduced, HB 514 limits zoning moratoriums to no more than 180 days. The Association worked to amend the measure to protect all residential property from zoning moratoriums, not just single-family. On the final day of the 2023 session, it was amended to include language from SB 136, which allows local governments to waive development impact fees on workforce housing projects without backfilling the fee.

Community Housing Options Increase Cost Efficiency Act (HB 1266)

Rep. Dale Washburn, R-Macon

Assigned to the House Government Affairs Cmte on Feb-15

HB 1266 provides for a system whereby certain local governments may seek certifications from the Department of Community Affairs upon the enactment of certain policies that can be used to receive priority in grant and loan applications submitted to state agencies to increase the state's supply of affordable housing.

Taxation & General Business Legislation

Consumer Privacy Protection Act (SB 473)

Sen. John Albers, R-Roswell

Considered by the Senate Science and Technology Cmte on Feb-15

SB 473 protects the privacy of consumer personal data, defined as information that is linked or reasonably linkable to an identified or identifiable individual. It allows a consumer to invoke these rights, including correcting inaccuracies, deleting personal information, obtaining a copy of their personal information, opting out of the processing of their personal information, etc. The controller of personal data is obligated to limit the collection of such information to what is adequate, relevant, and reasonably necessary.

Forms Executed via Electronic Signature (HB 1206)

Rep. Eddie Lumsden, R-Armuchee

Pending in the House Agriculture and Consumer Affairs Cmte

HB 1206 deems the failure of a business to provide or offer to provide a written copy of a form that a consumer executes via electronic signature to be unlawful as an unfair or deceptive practice. It requires any business that utilizes an electronic signature pad or similar mechanism to maintain the signature in a manner that is secure against unauthorized disclosure.

Reduce the Income Tax Rate (HB 1015)

Rep. Lauren McDonald, R-Cumming

Pending in the Senate Finance Cmte

HB 1015 reduces the rate of state income tax from 5.49% to 5.39%. This is one of the priorities of the Governor.